What is Product-Market Fit? Creating A Data-Driven PMF Framework

What is Product-Market Fit?

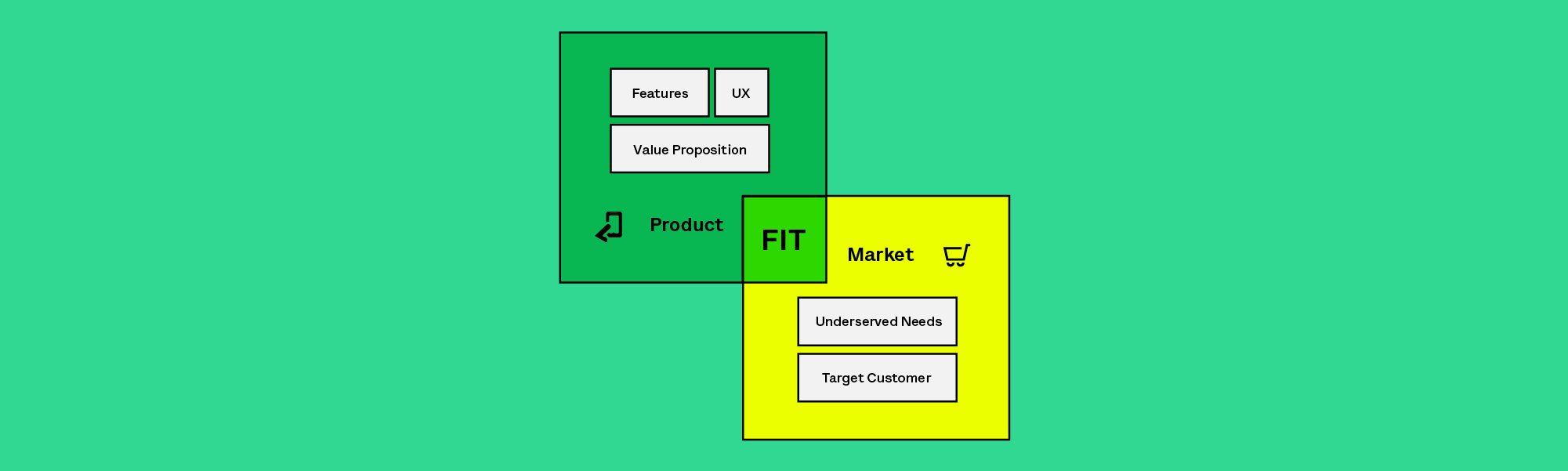

Product-Market Fit describes the degree to which a company has aligned its product offerings to its audiences’ needs and built a business model that monetizes that relationship. PMF is not a static condition. It’s best thought of as the iterative process of adapting to customer needs as they evolve.

The only thing that matters is getting to product/market fit.” —Rachleff’s Corollary of Startup Success

We agree—Product-Market Fit is a great definition of success for product and SaaS companies of all sizes. Really, goals like “improving the product” and “building a great product” are simply versions of “improving product-market fit.” But what is Product Market Fit? A great definition comes from Andy Rachleff, who describes product-market fit as a confluence of “the feature set you need to build, the audience that’s likely to care, and the business model required to entice a customer to buy your product.”

What is Product-Market Fit?

There are two important things to understand:

(1) Product-market fit is not a static condition.

(2) The bulk of activity within any company is oriented around refining or building on their product-market fit, whether the company describes what it’s doing in those terms or not.

The word “fit” is misleading. It sounds like arrival at a destination. Or a target you achieved at launch. It’s better to think of PMF as a process that can continually be refined. It’s an alignment, not an event. It’s more like market-product synchronicity. Adapting to evolving customer needs is an iterative process that never ends.

So how do you grab onto this slippery eel as your company grows and scales? Read on.

What are some basic tenets of Product-Market Fit?

PMF is vital at every level, from startup to enterprise.

At all stages of development, the degree of Product-Market Fit you’ve established captures your success at offering a product that will meet an audience’s needs so much that they’re willing to pay you for it. What counts as PMF changes as you add new features, reach out to new audiences, or change your messaging.

PMF-finding is both an art and a science.

Applying creative elements (like your team members’ experience, artistry, and hard-won instincts) to a rigorous scientific method supercharges productivity.

Data is the mine, but insights are the gold.

Insights are pieces of knowledge that change the story a company tells about its product, and that lead people to take informed action. The true value of collecting data is in the results it drives.

Keep a close eye on your market!

Too many teams over-rotate on product quality, while overlooking the pool of people willing to buy it. Keeping attention on the “M” in PMF gives your users privileged status in your development process. This market research literally pays you back—with sales.

What Are Some Best Practices For Pursuing Product-Market Fit?

When it comes to product-market fit, pay close attention to as many details about your concept of product and target market as you can.

Constantly gather feedback.

Encourage product teams to search for and isolate moments of friction. Many startups fail to notice these and address unexpected correlations.

Move rapidly and make many small steps.

Develop your minimum viable product as quickly as possible, then use both your imagination and experience to ask hypothetical questions, run lots of experiments, and gather relevant data. Trust your hunches—then test them!

Recognize where improving the product involves more than refining its features.

Things that can get “better” may include your market segmentation, sales cycle, packaging and distribution, and even your business model.

How do you measure Product-Market Fit?

Without precise data, product-market fit can be a nebulous concept. Getting it right requires gathering both quantitative and qualitative information, so keep as many of these indicators as possible working in your favor.

Learn about the key product metrics.

Survey your customers.

Growth expert Sean Ellis discovered that when at least 40% of users would find themselves “very disappointed” to be deprived of your product, you are experiencing PMF.

Discover your Net Promoter Score.

Net Promoter Score (NPS) ranks users by their likelihood to buy more product, remain customers long-term, and make the highest number of positive referrals.

Know the all-important retention rate!

Lean Product Playbook author Dan Olsen says, “Retention rate is the single best metric to measure your product-market fit.” It’s the percentage of your customers who are actively using your product. To calculate it, divide the number of active customers by the total number of customers and multiply by 100 to get a percentage.

Retention can be a particularly tricky metric to track. You need to distinguish between new customers and returning ones, and different customers will start (and stop) using your product on different dates. Graphing a retention curve is a way to visualize improvement made over time. And cohort analysis will help you understand long-term retention among your most important user groups. Each high-value user group can be its own “market”, and at any given moment you may have better PMF with certain user groups than with others.

What are the elements of success for finding product-market fit?

(1) It all starts with your market(s).

“The critical unit of analysis is the circumstance and not the customer.” —Clayton Christensen

In order to build a great product, you need a clear sense of (a) the problem you’re solving, and (b) whose problem it is—a.k.a. potential customers. (We developed a handy Problem Brief worksheet to help you do this!) When you’re small enough to still know every customer, you should be able to define your entire market with a single sentence.

Download our Problem Brief template.

(2) Next comes your product/service, and the teams that make it happen.

“There is only one valid definition of business purpose—to create a customer— [so] any business enterprise has…only two basic functions: marketing and innovation.” —Peter Drucker

Once you’ve targeted market problems, it’s time to build an org of teams that innovate on them faster than your competitors. Speed and accuracy are key, with teams moving quickly while ensuring their solutions are accurate. A great product org learns about its market through the shipping process: exploring customer usage of features, developing new hypotheses, offering new features to validate them, and so on.

At Heap, we advocate building by iterating. Ship an MVP, then test, measure, and tweak as quickly as possible. Don’t wait for the idea to be perfect—put something out there! The hard work is then learning what to do next from how users behave. We believe well-prepared and documented product hypotheses are better than product decisions. Want to evaluate the effectiveness of your hypotheses? We have another worksheet for you, our After Action Report.

Download our After-Action Report template.

(3) Now it’s time to optimize product-market fit.

You can’t improve PMF until you start measuring it. Since most digital businesses cite R&D as their biggest bottleneck, measuring accurately is especially critical. It’s not just about graphs and numbers. A great product org balances both qualitative and quantitative measures when making decisions.

Interested in making your product stand out? Read our complete guide to Product Differentiation.

(4) Start aligning your team on product-market fit.

“Every person in your company is a vector. Your progress is determined by the sum of all vectors.” —Elon Musk

Now comes the critical but unsexy task of making sure everyone marches in the same direction. (Don’t take this for granted! If aligning teams were easy, there’d be no such thing as product management.) As you grow, alignment might even be more important than getting your product-market fit thesis perfectly “right.”

What are the challenges in managing product-market fit at scale?

Basically, everything is now bigger and more complex, with more moving parts operating faster than before. Connecting the dots between business success and product success only becomes more difficult.

Scaling will expand you into new markets, and you’ll need to balance product investments across them. Even if you’re still serving your original persona, value proposition, and industry segment, never assume your market has remained static.

What are some areas to focus on when finding product-market fit at scale?

PMF can easily be lost when a company refuses to evolve with market changes, technological developments, and social dynamics. It’s now a multi-player game, and every player needs coverage. When you’re growing, here are some things to be aware of, and some good questions to ask:

Customer context

With hundreds and thousands of users, you’re working with a lower-resolution picture of your customer base.

How can you interview customers with minimal bias?

How can you understand the real drivers of activation and retention?

When should you deprioritize a market segment, and how do you pursue new ones?

Diffuse markets

You’re starting to see “across-the-chasm” uses of your product in ways you never anticipated, introducing competition you’ve never heard of.

How do you choose a new market by circumstance as well as user profile?

How can you identify the “unknown unknowns” in your product?

How should you think about creating new product lines after reaching scale?

Divergent priorities

You have to wrangle sales, support, engineering, product and leadership teams onto the same page.

How can you design an agile process between teams?

What’s the most efficient way to collect input from stakeholders?

What are the best frameworks for product leaders to hold PMs accountable?

Parallel strategies

There are more engineers, designers, and PMs onboard than you ever imagined. They’ll need clear, distinct areas of ownership.

How do you create an effective company blueprint?

How can you connect feature usage to higher-level business metrics?

What are ways to diagnose an analytics trend and hunt it down to its root causes?

How Will Heap Help My Company With Product-Market Fit?

Heap gives companies an easy way to capture data that provides complete and predictive insight. Measuring everything tells you more than just which features different groups of people like. You can dig deeper what each cohort did before and after using those features, and which attributes or behaviors best correlate with use of specific features.

For example, plenty of tools can tell you if a feature’s adoption rates are low (learn about product adoption here). But what if you want to discern if the feature is hard to discover? Heap can tell you if users are following the expected path to that feature or not. Or whether the cohort you designed that feature for is using it. Or what other actions people using that feature take in the product.

When teams fully understand how customers interact with your product/service, their takeaway is the power to be proactive rather than reactive when prioritizing efforts and leveraging insights. This creates clear paths to effective action aimed at giving customers what they want most.

At Heap, everything we do is designed to assist you to better understand your business, your customers, and therefore your product as well. Reach out and let us know how we can help.

Want to dive deeper into PMF? Here are three guides we like:

The Lean Startup Playbook for Achieving Product-Market Fit by Eric Ries

The Never-Ending Road To Product Market Fit by Brian Balfour

The Only Thing That Matters by Marc Andreessen

Getting started is easy

Interested in a demo of Heap’s Product Analytics platform? We’d love to chat with you!