Going Beyond Web Analytics by Bringing In Salesforce Data (Automatically)

A few months ago, I wrote that most SaaS salespeople were leaving money on the table because they do not look at their prospects’ or customers’ behavior to win deals. After writing this, I saw the adoption of Heap skyrocket among Heap’s own sales team.

I also saw the number of active Heap users at our B2B SaaS customers grow and soon pondered, “This can’t be from people reading my blog, right? This growth must be from our sales efforts.” The reality was: I could not tell. The data to answer this question only existed in our Salesforce instance.

I was not alone in wanting to ask and answer more sales-specific questions in Heap. When I spoke with other companies, I realized they all wanted to use their Salesforce data to do more advanced customer analysis.

Our new Salesforce → Heap integration bridges this gap. It automatically pulls in all customer and account data that lives exclusively in Salesforce, including customer fields (Customer Type, Roles, Industry, ARR, Permissions, Health Scores), and customer touchpoint events (sales calls, automated emails from ESPs, text communications, or direct mail campaigns). Combining Salesforce data with in-product behavioral data lets us answer a whole new class of questions. More importantly, it helps us define our evolving go-to-market strategy.

Below, I will explain how we do this across the entire customer lifecycle.

Using Analytics to Define Target Personas

Understanding your target persona often means munging a bunch of disparate data sets together. At worst, it means going with your gut and anecdotal experience.

Our Salesforce→Heap integration organizes business logic (ARR, Health Score), CRM data (customer role, company industry, geo), attribution data (first touch, last touch), and user behavior (how they use our product) into a simple, unified user-event model. This makes it easy to answer key questions like:

– Which of our enterprise customers get the most value?

– Which role within an org is most likely to sign up first?

– How do our highest value customers find us?

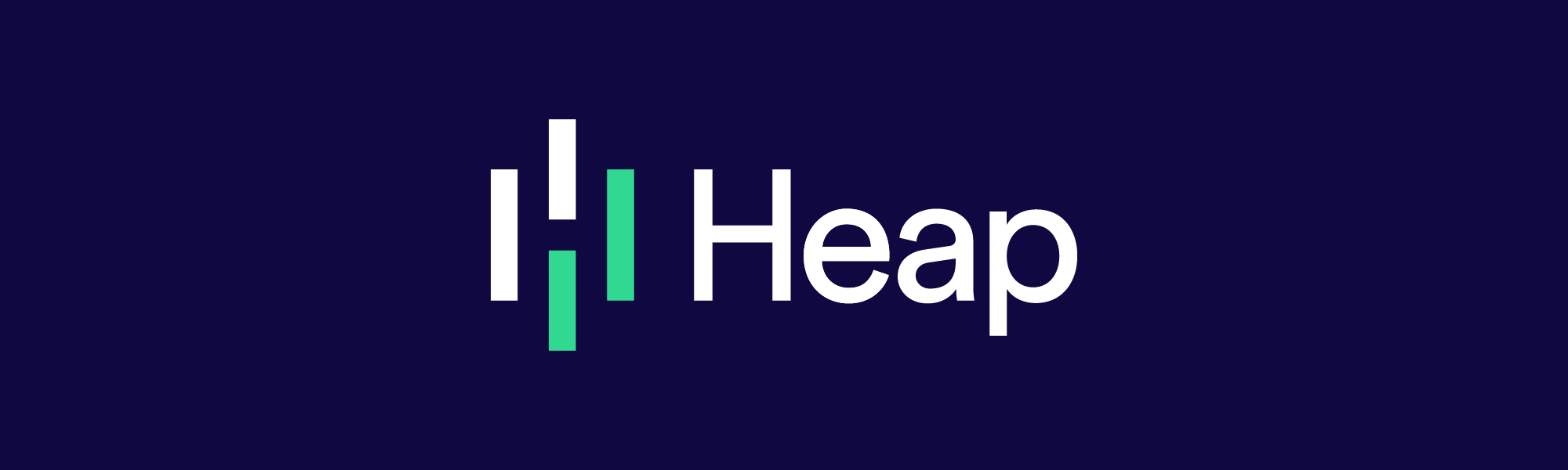

The first step is finding out who gets the most value from your product. At Heap, our customers receive value when they run frequent analyses. Thus, we want to measure how frequency of usage corresponds with role (product, marketing, design) and industry type (B2B, SaaS, E-commerce, FinTech).

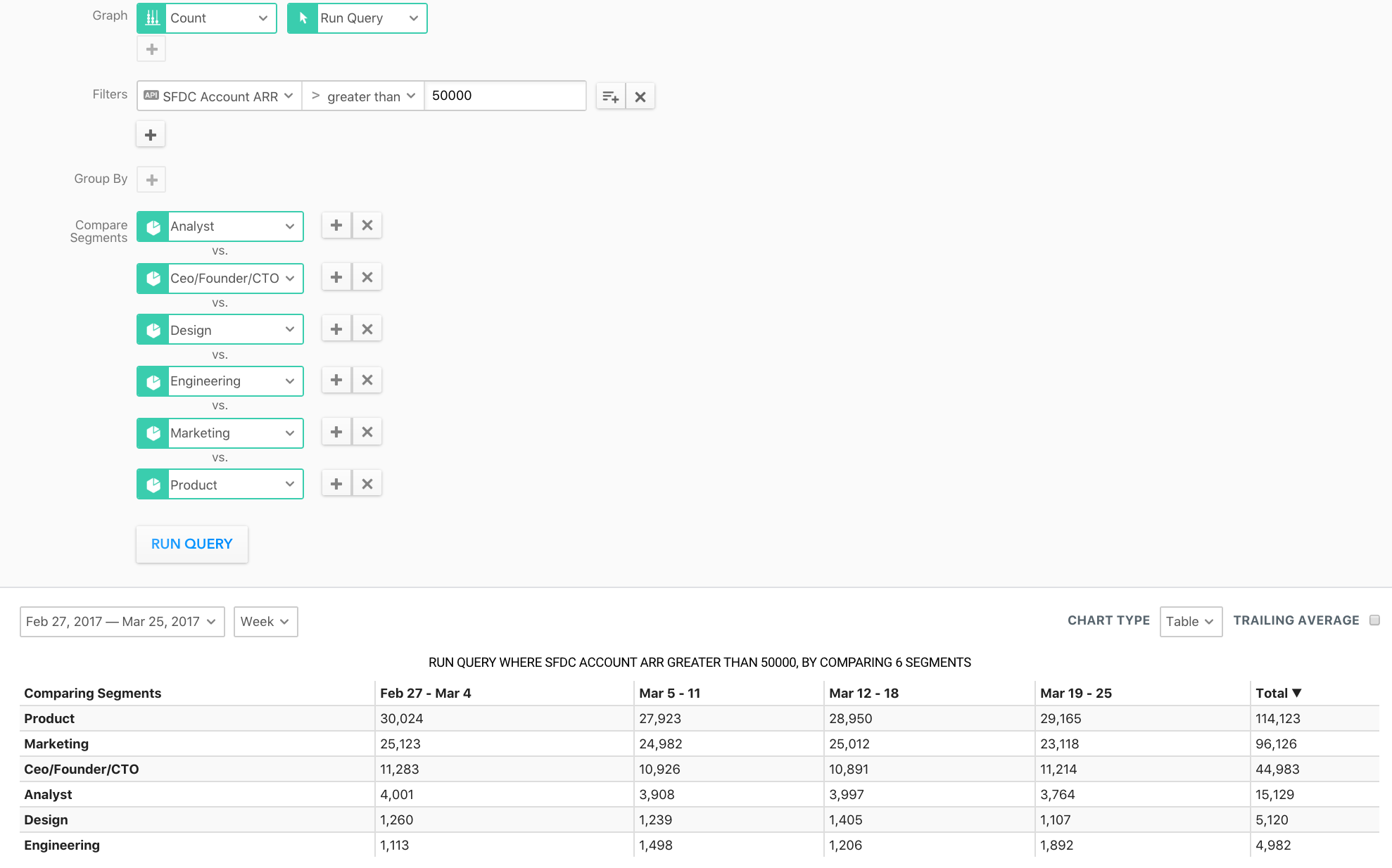

Using Clearbit, we can enrich our Salesforce data to attach fields like Role and Industry to our leads, contacts, and accounts. Then, we can (automatically!) bring Salesforce data into Heap, which lets us answer questions like “What roles use Heap most frequently?” As we sign on larger and larger customers, we can also begin analyzing how a company’s employee count and revenue affects their Heap usage.

Once we have an idea of what an ideal target persona looks like, we can begin to analyze what led them to Heap in the first place. Did we drive them to Heap through ad campaigns, marketing content, sales touches, or something else?

In the example above, it’s clear that product teams are the most active users of Heap. But are they the ones that initially sign up for Heap from their organization? Not necessarily. Answering these questions is critical in determining how to allocate marketing spend and how we develop outbound strategies to acquire more of these customers.

Targeting Our Ideal Personas

We know product teams at SaaS companies and marketers at E-Commerce companies are the heaviest users of Heap. But they’re not necessarily the ones to bring Heap to their organizations. It turns out that CEOs, founders, and directors are much more likely to create a Heap account in the first place!

We can use this insight to inform our outbound processes and create ad campaigns to target CEOs, founders, and directors. Then, we can use Heap to measure our campaigns to see whether we’re efficiently attracting the right customers.

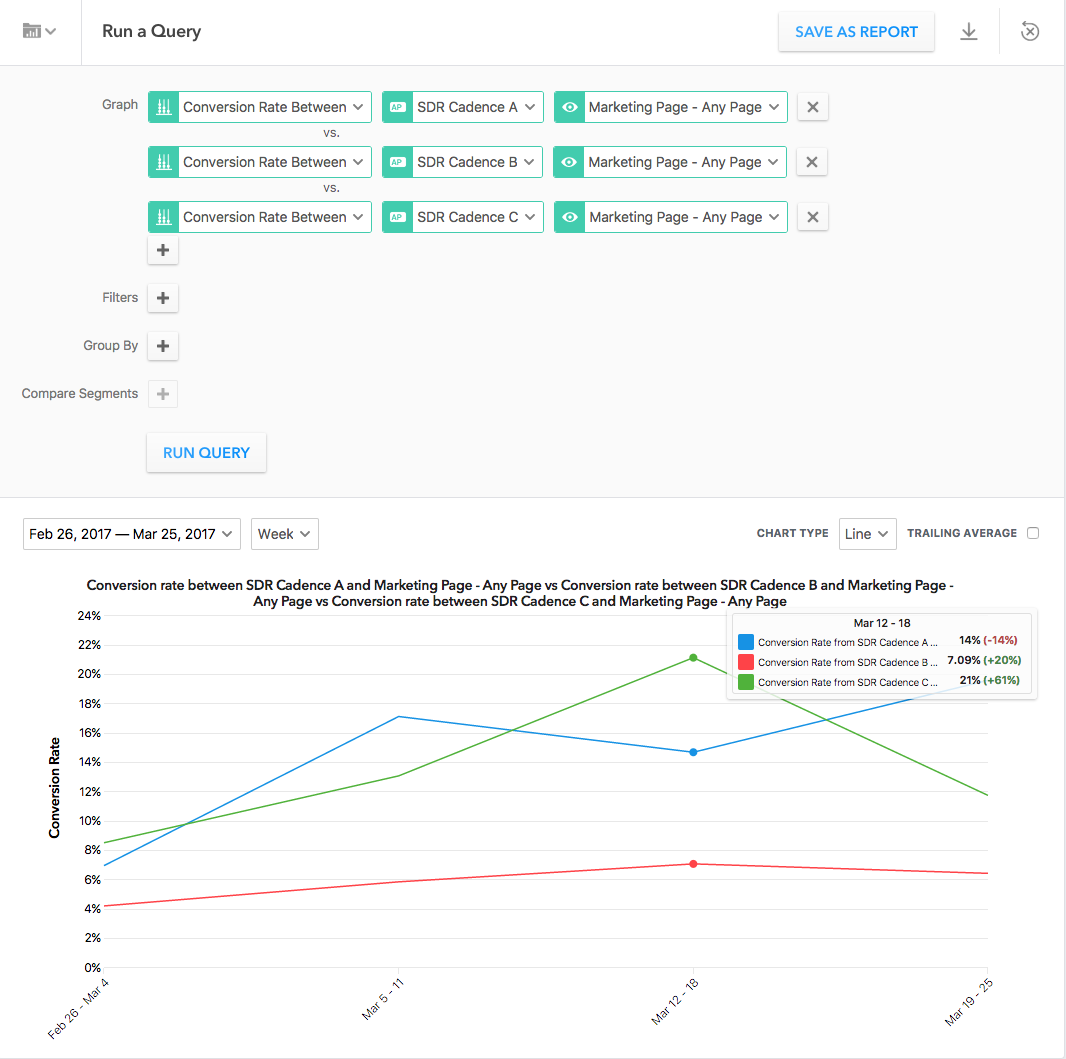

We experiment with different cadences in our sales process, and each email and phone call in a given cadence is logged as a touch point in Salesforce. Thus, we need Salesforce data to measure these outbound efforts and campaign.

The Salesforce→Heap integration allows us to bring each touchpoint as an event in Heap associated with a lead. We recently A/B tested three different cadences with product teams, and measured which ones were most effective at driving leads to visit Heap. We can measure the conversion of those leads, and even measure which cadences get leads to convert to paying users in the shortest amount of time!

Converting Trial Users

It is the sales team’s job to convert these leads into paying customers once they are driven to a free trial or demo. The Salesforce→Heap integration helps our sales team better understand trial users by automatically bringing in data around lead/account owners, company segments, and geographies.

For instance, Shea (an Account Executive at Heap) can list all his opportunities in a trial phase, receive alerts when new teammates are added, and set up emailed reports based on actions that his opportunities do (or do not) take.

He can also look at his active accounts to find common behaviors that suggest they might be ripe for up-sell or cross-sell. For instance, Shea sold Heap to a small product team at a large organization. He then noticed that team had installed Heap on a new, public facing marketing site and that three marketers were actively logging into the account. He can now start a conversation with the marketing team by sending them a highly-targeted email based on their behaviors in Heap.

Educating and Retaining Customers

Once we’ve closed a deal, it is time to ensure Customer Success (CS) can properly educate, onboard, and retain this customer. It is their job to make sure the customer can easily pull important insights from Heap and to increase Heap’s adoption within an organization. CSMs can analyze their accounts’ activities in-depth to plan trainings per department, re-engage inactive members, and troubleshoot any difficulties.

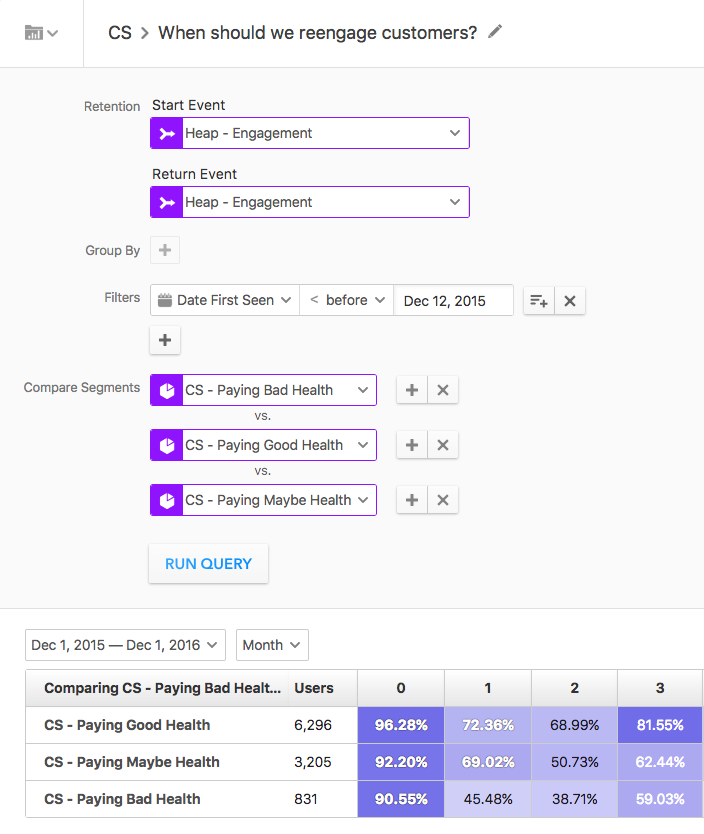

To achieve this, we can use Heap’s retention tool to monitor when customer usage drops off. This gives us insight into whether we need to proactively reach out to customers to trigger their re-engagement.

Many companies (including Heap) calculate lead score, health score, or churn risk based off a combination of in-product activity, sales activity logged in their CRM, and company metadata. With the Salesforce→Heap integration, we can calculate this Health Score much more easily. Then, we can see how well our customer success team is doing by tracking how these Health Scores change over time.

Conclusion

Using data is essential to forming a sound go-to-market strategy. Unfortunately, consolidating that data into one place is too often a daunting engineering task.

The Salesforce→Heap integration automates this work and combines the sales data in Salesforce with the product data in Heap. This lets you build a complete picture of the user lifecycle and more intelligently iterate, test, and improve on every aspect of your business.

Interested in learning more? Contact sales@heapanalytics.com