What Unsustainable Growth Looks Like: Herbalife, Groupon, and More

One of the most important characteristics of a successful start-up, and even many other companies, is that it’s growing. As long as your graph of revenue or users is moving up and to the right, things are probably going well.

Sometimes, however, growth hides the fact that a business is on the verge of failure.

How is this possible? I’ll illustrate using an example. Let’s say you open a store that sells deep-fried waffles. People love your waffles, and your sales are high, so you raise some capital from investors to open five more waffle stores in other cities. At this point your growth looks amazing: you’ve gone from 1 store to 6 in a short period of time, and you’re generating plenty of revenue.

Here’s where you see the first sign of danger: your original store’s sales are falling, because the novelty of deep-fried waffles has worn off in the first city. But total growth is still strong, with 5 successful stores and just 1 failing store, so you raise another round of investment and open stores in 25 more cities. Now, those previous 5 stores are starting to fail as well, but the 25 new stores are showing strong growth, so total growth is still up!

At this point you can probably see the pattern. Continued expansion makes your total growth look amazing, but the business is unsustainable, and you’ll soon run out of new cities to expand to.

(This is a fictional example. In real life, people would never get tired of deep-fried waffles.)

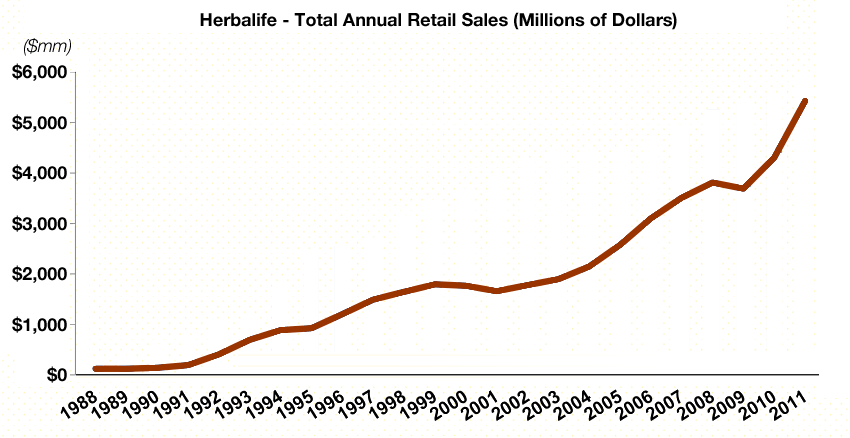

Herbalife: A Real-Life Example

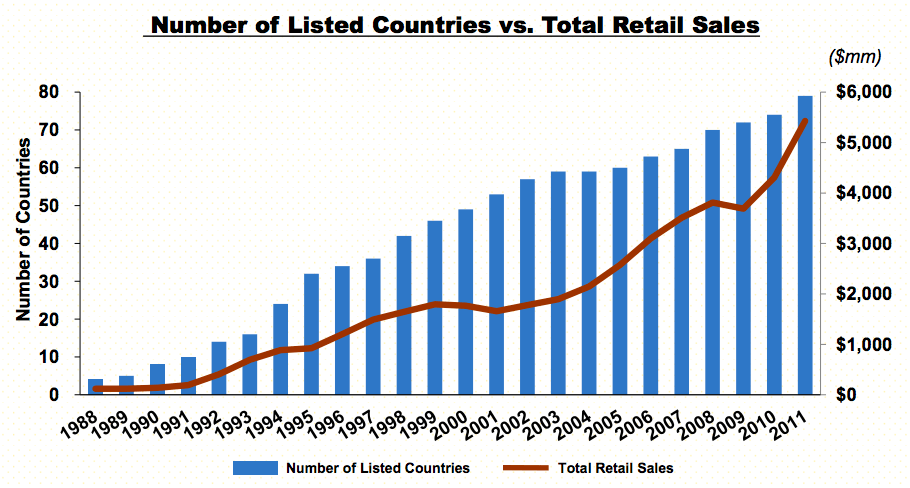

If that fictional waffle business seems contrived, let’s look at a real-world business that this is actually happening to. Herbalife is a nutritional supplement company that touts the health benefits of its products. But unlike their competitors Slim-Fast or Ensure, you won’t see Herbalife at your local supermarket. Instead of selling products via retail outlets, their products are sold by individual salespeople who operate on commission. Herbalife salespeople can also earn commission on other salespeople that they recruit. Herbalife’s growth over the last few decades has been amazing:

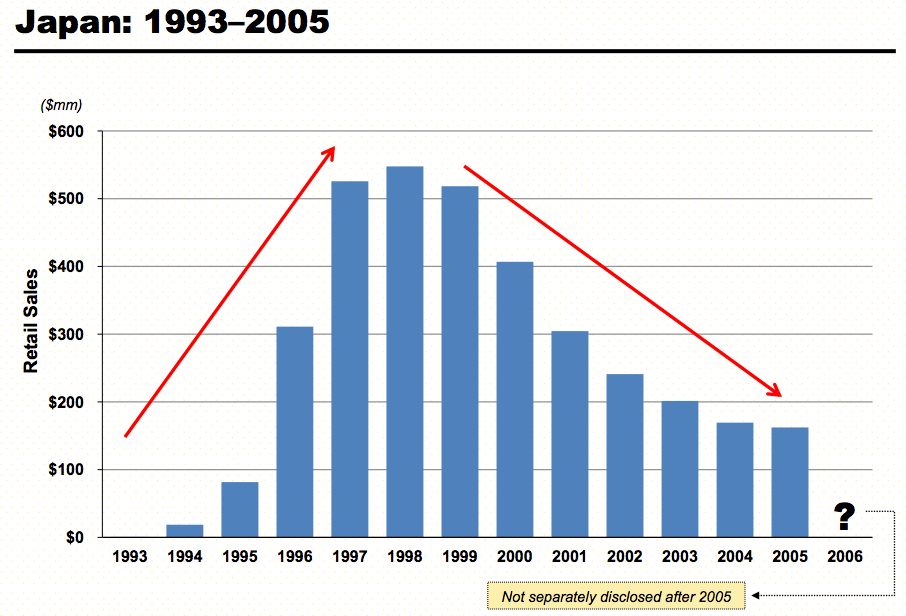

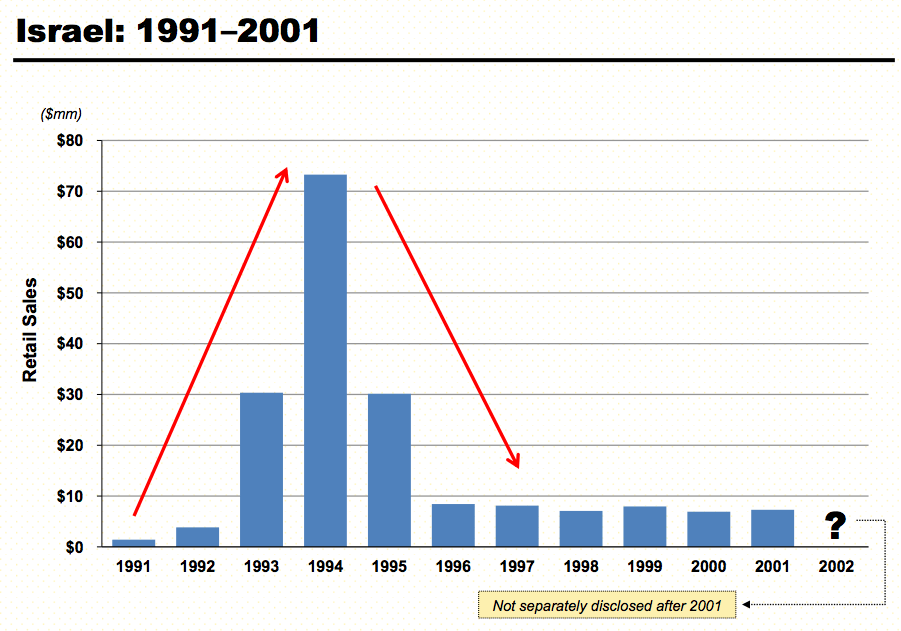

But according to investor Bill Ackman, this growth masks an unsustainable business. Ackman and others claim that Herbalife is a pyramid scheme that is propping up its growth by continually entering new foreign markets. In every country that Herbalife enters, revenue skyrockets (the “pop”) before the network of salespeople implodes (the “drop”). The majority of revenue isn’t earned via legitimate product sales, but rather by salespeople recruiting other salespeople and getting them to buy product upfront. Eventually, a market gets saturated with salespeople, and the scheme collapses.

Ackman showed that this “pop-and-drop” pattern was happening with Herbalife in several of the countries they entered:

Along with Japan and Israel, this same pattern shows up in Spain, France, Germany and several other countries that Herbalife has entered. Let’s take a look at that revenue graph from before, but overlaid with the number of countries that Herbalife has entered:

Now we see that Herbalife’s revenue is correlated with entry into new markets. Eventually they’re going to run out of countries to enter, and that will be the end of Herbalife if they don’t figure out a more long-term, sustainable business model.

I’m not running a pyramid scheme. So how is this relevant to my business?

There are legitimate businesses that can fall victim to the same scenario. Our waffle business exhibited this pattern at each of its stores. It wasn’t because it was a pyramid scheme; it was because the demand dried up after the initial novelty. Here are two examples of legitimate businesses that exhibit this pattern:

Groupon was one of the fastest-growing startups of the last ten years, worth over $15 billion dollars soon after its IPO. A lot of Groupon’s revenue growth was fueled by aggressive and increasing sales efforts in new cities. But many businesses that participated in Groupon’s daily deals found that they lost money, which dampened the market for repeat businesses. Also, revenue per subscriber and number of Groupons sold per customer declined as well in each city. In the last couple years, these flaws in Groupon’s growth model have caused their stock price to collapse. Now, the company’s market cap is less than a third of its peak.

LikeALittle was a social network that showed massive growth, with over 20 million pageviews in just 6 weeks after launch. They used a Facebook-like strategy of rolling out to colleges one at a time. But unlike Facebook, college students stopped using the website soon after it was introduced and the initial hype died down. I was in college at the time, and remember the site being popular for about a week. Their constant rollout to new colleges masked their growth problems, but not for long: LikeALittle closed shop about a year after launching.

Lessons Learned

As these cases show, growth can be illusory. So how can you make sure you’re seeing meaningful growth? You should be able to demonstrate sustained growth in a single market segment, whether it’s a geographic region, a certain type of customer, or something else.

To avoid being taken by surprise, you should be mindful of your churn rate: the percentage of customers who stop using your service each month. The flipside of churn is retention, or the tendency for users to come back. If you’re starting to see high churn and low growth in one of your more mature market segments, this may be an indication of bad things to come for the rest of your business.

Ask questions about churn and retention in targeted ways. What does churn look like for my enterprise customers? How engaged are people who signed up a year ago? If you’re vigilant about this process, you’ll spot warning signs before they threaten your entire business.

Note: the graphs included in this article were sourced from Pershing Square Capital Management’s initial presentation on Herbalife.